Our History

DSL Business Finance was formed in 1993 in response to research into the difficulties faced by people from under-invested communities when attempting to access funding for new or existing businesses.

In response, the Glasgow Regeneration Fund (GRF) was established to provide microfinance to entrepreneurs in Glasgow. GRF raised more than £3 million from public and private-sector sponsors, including ERDF, Glasgow City Council and Scottish Enterprise Glasgow. The private sector also made significant financial contributions, including support from The Body Shop, Royal Bank of Scotland and British Petroleum.

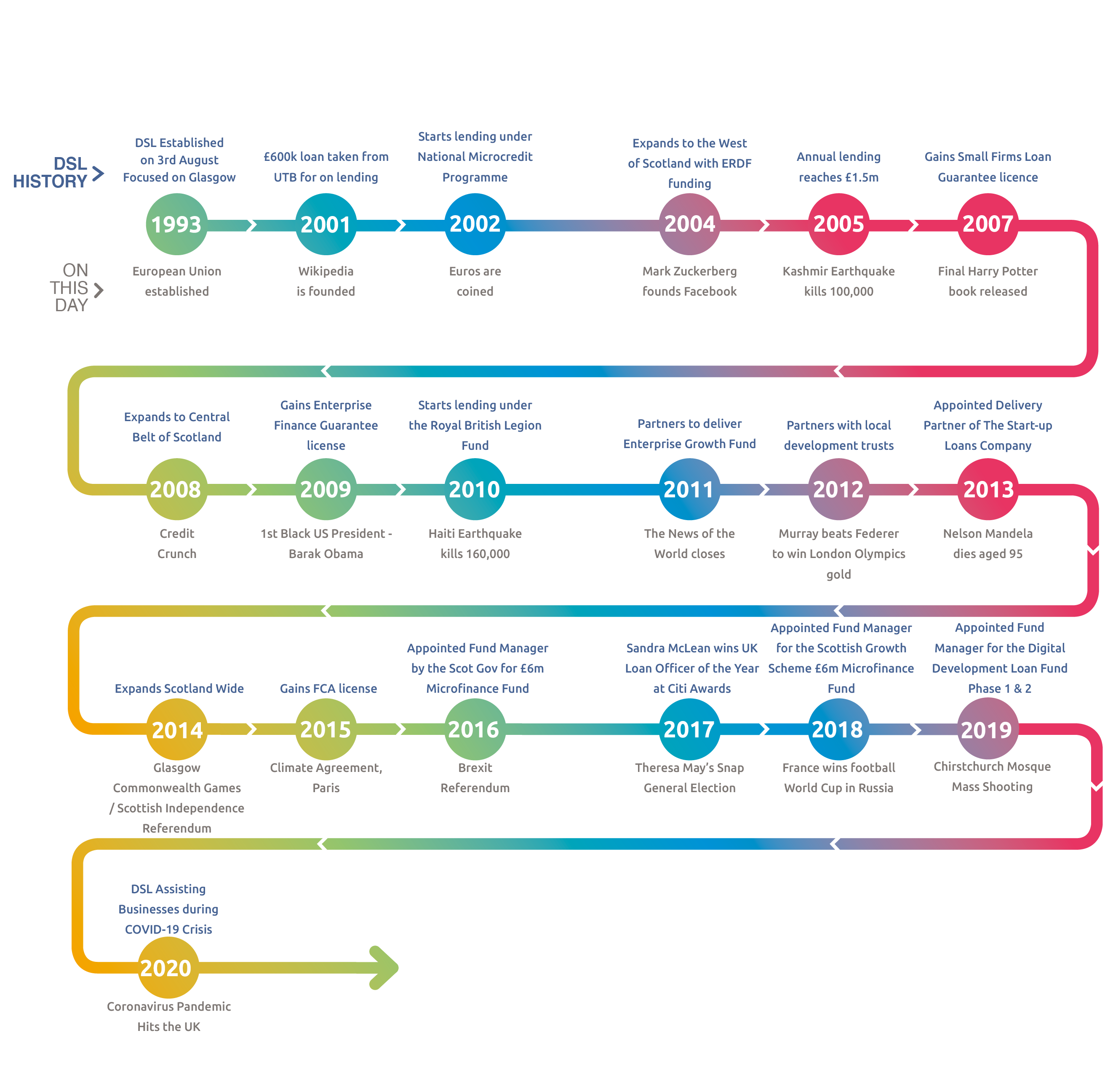

DSL TIMELINE